USB Power Port Ready retractable USB charge USB cable wired specifically for the Garmin Nuvi 1340 and uses TipExchange

Vhbw Li-Polymère batterie 1250mAh pour système de navigation GPS Garmin Nüvi 1340, 1690 - Cdiscount Auto

Gomadic Brand Flexible Car Auto Windshield Holder Mount designed for the Garmin Nuvi 1340 - Gooseneck Suction Cup Style Cradle - Walmart.com

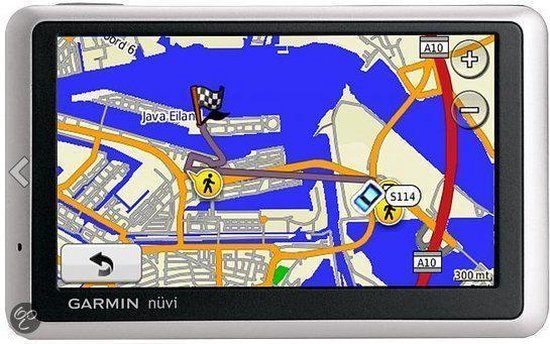

4.3"inch 20000494-14 At043tn24 V.4 For Garmin Nuvi 1340 1350 1370 1390 Lcd Display + Touch Screen Digitizer Replacement - Buy Tablet Lcds & Panels,Computer & Office,Cheap Tablet Lcds & Panels Product on Alibaba.com

4.3''inch Complete Lcd Display For Garmin Nuvi 1340 1340t 1370 1370t Full Lcd Screen Display Replacement (version Lq043t1dh42) - Touch Screen Panels - AliExpress

Amazon.com: MPF Products 1200mAh 361-00019-16 Battery Replacement Compatible with Garmin Nuvi 1300, Nuvi 1340, 1340T Pro, 1350, 1350T, 1370, 1370T, 1375T, 1390, 1390T, 1490 GPS Navigation Units : Electronics